親愛的CFA學(xué)員:歡迎來到融躍教育CFA官網(wǎng)!

距離 2024/11/13 CFA一級(jí)考期還有 天!

全國熱線:400-963-0708

全國熱線:400-963-0708  網(wǎng)站地圖

網(wǎng)站地圖

發(fā)布時(shí)間:2022-02-13 09:29編輯:融躍教育CFA

CFA三級(jí)知識(shí)考察考生的綜合和應(yīng)用能力,在備考中也是要學(xué)習(xí)知識(shí)的,那在CFA知識(shí)中的股票投資相關(guān)知識(shí)你是不是掌握了?知道CFA知識(shí)點(diǎn)中的作用有哪些?跟著小編看看!

股票投資主要有4方面的作用:capital appreciation、dividend income、diversification、 potential to hedge inflation。

01、Capital Appreciation資本增值

Capital appreciation results from investing in companies that are experiencing growth in cash flows, revenues, and/or earnings.

資本增值來自于企業(yè)盈利能力和現(xiàn)金流的成長。

(1)Equity returns on average have been higher than bonds and bills.

長期來看,股票的收益高于債券;

(2)In general, equities tend to outperform other major asset classes during periods of strong economic growth, and underperform during periods of weak economic growth.

一般而言,經(jīng)濟(jì)狀況好時(shí),股票優(yōu)于債券;經(jīng)濟(jì)狀況差時(shí),債券優(yōu)于股票。

02、Dividend Income獲得分紅

When companies generate excess cash flows, they can decide to either reinvest those cash flows in value added projects or distribute them to investors in the form of dividends. Wellestablished companies often pay dividends to investors.

企業(yè)可以選擇將盈利再投資,也可以以紅利的方式發(fā)放給股東。成熟的企業(yè)一般選擇分紅。

03、Diversification分散化

Equity securities offer diversification benefits due to less than perfect (i.e., less than +1.0) correlation with other asset classes.

股票可以起到分散化的作用,降低整個(gè)投資組合的相關(guān)性。

(1)When assets are less than perfectly correlated, portfolio standard deviation will be lower than the weighted sum of the individual asset standard deviations.

只要各類資產(chǎn)之間的相關(guān)性不是1,那么組合的風(fēng)險(xiǎn)就低于各資產(chǎn)波動(dòng)性的加權(quán)和;

(2)During a financial crisis, correlations tend to increase, limiting the diversification benefit.

經(jīng)濟(jì)危機(jī)發(fā)生時(shí),各資產(chǎn)的相關(guān)性會(huì)增大,即使組合投資比較分散,效果也會(huì)減弱。

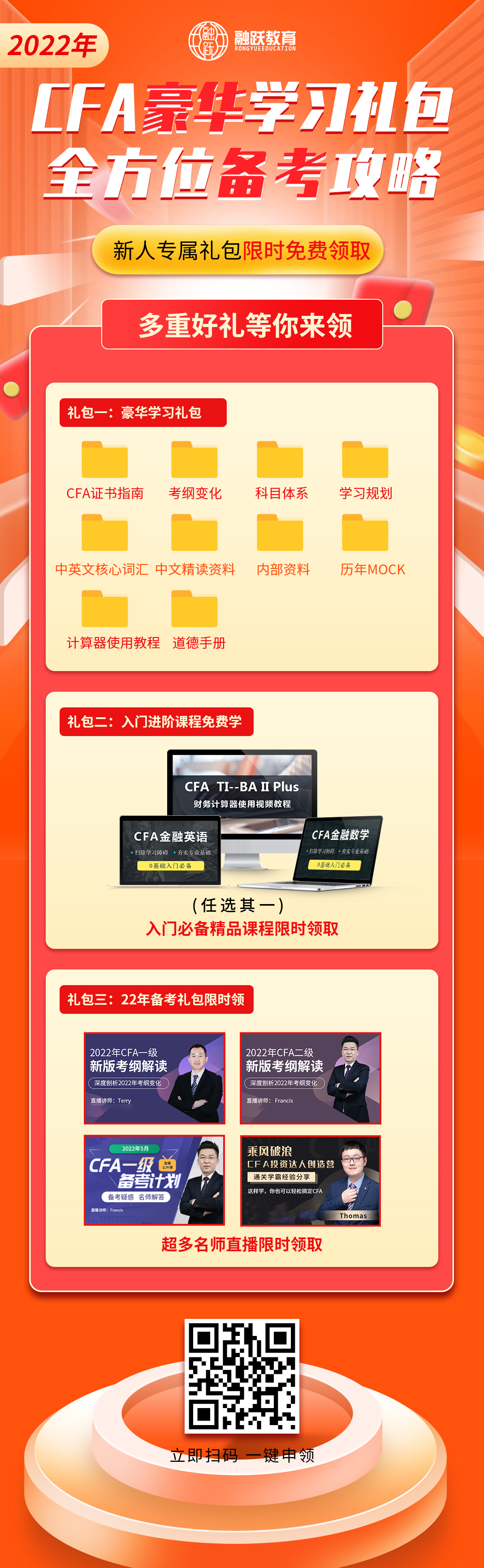

CFA備考怎么能少了CFA備考資料呢?小編為各位考生準(zhǔn)備了CFA備考資料,有需要可以點(diǎn)擊下方鏈接獲取!

戳:各科必背定義+歷年真題中文解析+學(xué)習(xí)備考資料(PDF版)

04、Inflation Hedge對沖通脹

Individual equities or equity sectors may provide a hedge against inflation.

某些板塊的股票 是可以對沖通脹的。

(1)A company that can charge its customers more when input costs increase (due to inflation), can provide an inflation hedge by increasing to cash flow and earnings as prices increase.

提價(jià)能力較強(qiáng)的公司可以轉(zhuǎn)嫁成本給顧客;

(2)Commodity-producing companies (e.g., oil producer) may also benefit directly from commodity price increases.

生產(chǎn)原材料的公司在通脹時(shí)盈利能力提高;

(3)Some studies show that equities and inflation become negatively correlated during periods of hyperinflation.

惡性通脹時(shí),股票收益與通脹水平負(fù)相關(guān);

CFA知識(shí)學(xué)習(xí)是長期的事情,但是堅(jiān)持CFA考試是每一位學(xué)員應(yīng)該做到的。通過CFA考試掌握更多的金融知識(shí),讓自己變成富有的人。更多CFA備考知識(shí)、資料領(lǐng)取及學(xué)習(xí)答疑的事情,學(xué)員可以在線咨詢老師或者添加老師微信rongyuejiaoyu。

CFA學(xué)習(xí)資料(掃碼免費(fèi)領(lǐng)取)

1、新手入門

1、新手入門

2、學(xué)習(xí)資料

2、學(xué)習(xí)資料

3、免費(fèi)課程

3、免費(fèi)課程

4、考試動(dòng)態(tài)

4、考試動(dòng)態(tài)

5、備考干貨

5、備考干貨

6、答疑沖刺

6、答疑沖刺

上一篇:2022年CFA考試安排有做調(diào)整?常規(guī)時(shí)間是何時(shí)?

下一篇:2022年5月CFA三級(jí)更改考點(diǎn)截止到北京時(shí)間4月24日中午12:59!

精品文章推薦

距 2024/11/13 CFA考期 還有

打開微信掃一掃

添加CFA授課講師

課程咨詢熱線

400-963-0708

微信掃一掃

還沒有找到合適的CFA課程?趕快聯(lián)系學(xué)管老師,讓老師馬上聯(lián)系您! 試聽CFA培訓(xùn)課程 ,高通過省時(shí)省心!