親愛的CFA學(xué)員:歡迎來到融躍教育CFA官網(wǎng)!

距離 2025/2/17 CFA一級考期還有 天!

全國熱線:400-963-0708

全國熱線:400-963-0708  網(wǎng)站地圖

網(wǎng)站地圖

發(fā)布時間:2020-06-10 10:06編輯:融躍教育CFA

Which of the following is least likely to be considered a warning sign of aggressive revenue recognition?

A) Bill and hold arrangements.

B) Capital-type leases.

C) Recognizing revenue from barter transactions with third parties.

D) Sales-type leases.

The correct answer was B) Capital-type leases.

Sales-type leases in which the lessor recognizes a sale at the inception of the lease can be used to book revenue too soon. Capital-type leases do not have this impact because they recognize revenue over the life of the lease. Bill and hold arrangements and recognizing revenue from barter transactions can also be used to manipulate revenue.

This question tested from Session 7, Reading 30, LOS c

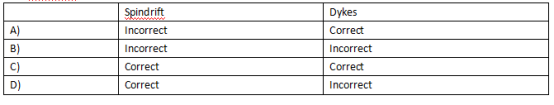

Are Spindrift’s and Dyke’s statements about earnings manipulation at Sunbeam correct?

The correct answer was A) Incorrect Correct

Spindrift’s statement is incorrect. Receivables and inventories increasing faster than sales was a sign of earnings manipulation at Sunbeam. Sales increasing faster than receivables and inventories can be a sign of more efficient operations. Dykes’ statement is correct.

This question tested from Session 7, Reading 30, LOS c

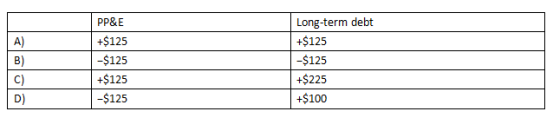

The correct adjustments for PP&E and long-term debt would be closest to:

The correct answer was C) +$125 +$225

PP&E would be adjusted up by the $125 present value of long-term leases for a total value of $425 + $125 = $550. Long-term debt would be calculated at market value and adjusted up for the present value of long-term leases: $500 + $125 = $625 relative to a reported value of $400, for an adjustment of +$225.

This question tested from Session 7, Reading 30, LOS c

Which of the following was least important as a warning sign of earnings manipulation at Enron in its financial statements for the fiscal year 2000?

A) Use of the equity method to account for investments and reporting pro-rata earnings of the investee in net income.

B) Related party transactions in which an Enron employee served as general partner in limited partnerships engaging in transactions with Enron.

C) Sales of securitized assets at inflated values to SPEs.

D) Senior management’s compensation was based mostly on bonus and stock awards.

The correct answer was A) Use of the equity method to account for investments and reporting pro-rata earnings of the investee in net income.

In the equity methods, the pro-rata earnings of the investee are correctly reported in net income. Enron’s misuse of the equity method involved reporting the investments at fair value, not including pro-rata earnings in net income. The other statements are all examples of red flags in Enron’s fiscal year 2000 financial statements.

This question tested from Session 7, Reading 30, LOS c

CFA學(xué)習(xí)資料(掃碼免費領(lǐng)取)

1、新手入門

1、新手入門

2、學(xué)習(xí)資料

2、學(xué)習(xí)資料

3、免費課程

3、免費課程

4、考試動態(tài)

4、考試動態(tài)

5、備考干貨

5、備考干貨

6、答疑沖刺

6、答疑沖刺

上一篇:每日一練:CFA考試題英文版試題(2020.6.8)

下一篇:每日一練:CFA考試題10科各一道(2020.6.17)

精品文章推薦

打開微信掃一掃

添加CFA授課講師

課程咨詢熱線

400-963-0708

微信掃一掃

還沒有找到合適的CFA課程?趕快聯(lián)系學(xué)管老師,讓老師馬上聯(lián)系您! 試聽CFA培訓(xùn)課程 ,高通過省時省心!